A couple of weeks ago, AUI announced a new partnership with Groupe Banque Populaire to provide 0% interest loans for AUI students. Named “AVENIR-PLUS”, this new product would allow AUI students to benefit from more attractive interest rates and conditions to cover “Registration fees and/or tuition & fees, Loan Application Fees, and Death and disability insurance premium covering the student loan.”. In addition, BP also offers another product dedicated to parents who want to finance any remaining fees (cash wallet, housing, etc.)

AVENIR-PLUS: 0% interest for 5 years, then 5.20% (without tax) during the repayment period

AVENIR-PLUS is a product that targets students and unlocks an amount of up to 50.000 MAD per year for the fees mentioned above.

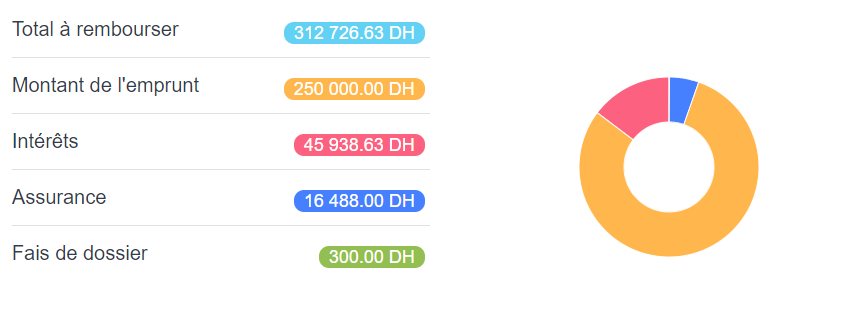

According to our sources, no interest will be charged if a student can repay the total amount of the loan by the end of the fifth year. However, if a student opts for a deferred payment (meaning not paying until the end of the grace period of 1 year), interest, insurance, and fees will be charged. This means that after the fifth year:

- 5.2% interest (5.72% with VAT) will be applied

- A 300 MAD application fee will be added

- A 1.1% annual insurance fee will be added (Décès-Invalidité)

AVENIR-PLUS conditions and fees are competitive if compared with other products currently available on the market, as rates hover around 6 to 7.5% in other banks with restrictive conditions on repayment and grace periods. Nevertheless, the costs of a bank loan are still considerable especially since the CCG guarantees 60% of the loan in case of default.

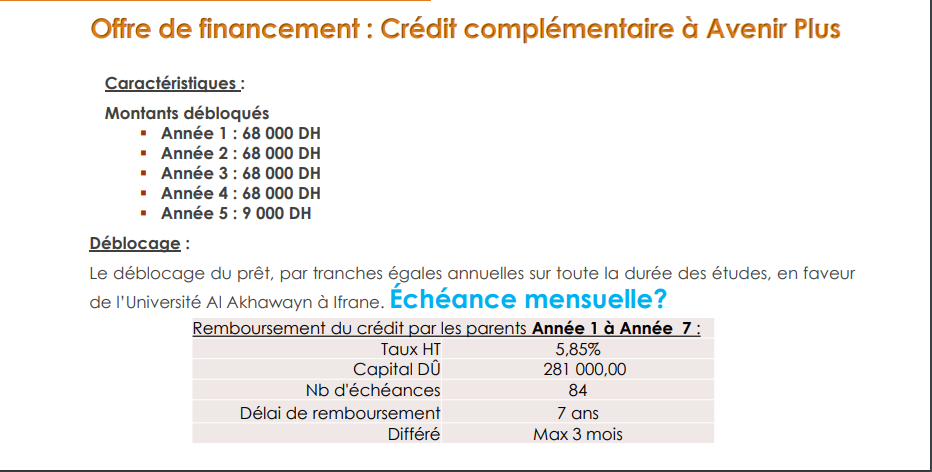

For additional fees, parents can still request an additional loan

Parents can also request an additional loan to cover other living costs and fees. For this product, up to 68.000 MAD per year can be disbursed from the first year to the fourth year, and 9.000 MAD in the fifth year. A slightly higher interest rate of 5.85% (without VAT) is charged as well as 300 MAD for the loan application fees. The repayment period is set to 7 years.

Parents will be able to receive up to 281.000 MAD over 5 years and pay low monthly installments from the first year until the seventh year. They can only defer the payment by 3 months if they request it and suspend one monthly installment per year.

Once again, the breakdown of fees is as follows:

- 5.85% interest (6.435% with VAT) will be applied

- 300 MAD application fee

- As this loan might be categorized as “Crédit à la consommation” and not a student loan “Crédit Etudiant”, a 2.57% insurance fee might be charged instead of the 1.1% fee. We cannot confirm this information at the moment.

Who is eligible?

After the announcement of the new partnership between BCP and AUI, many were wondering if continuing students can benefit from these new products. While no details were mentioned on the marketing material communicated by the bank, AUI updated its statement recently to include that only future students can benefit from these advantageous conditions. Facebook and Instagram ads also mentioned that the new offer is targeted to prospective students.

It is important to note that continuing students can still apply for a bank loan at any semester, however, conditions and interest fees are different (6.95% without VAT, and a maximum of 20.000 MAD to be released every semester).

It is also worth mentioning that all offers are subject to university and bank approval, based on documents and information provided on the application form.

The deadline to apply to AVENIR-PLUS or to the loan that covers additional funds is September 14th, 2020.